The impact of cascading effects on financial systems

Distress initially affecting a small part of the economy can potentially spread to the entire system, as seen in the global financial crisis and most likely reconfirmed during the ongoing corona virus crisis.

22 April 2020

Sumit Sourabh, Drona Kandhai, and Ioannis Anagnostou of the Computational Science Lab, in collaboration with Markus Hofer and Javier Sanchez Rivero, developed a novel method for estimating financial contagion effects from market data using techniques from computational modelling and machine learning. Their methodology is applied to actual pricing and risk management models and stress-scenario testing. The impact of a highly interconnected financial system is shown to be significant for the pricing of financial derivatives, as well as the amount of capital that financial institutions need to hold in order to absorb unforeseen losses. The results highlight the need for a dynamic extension of the current modelling framework by accounting for financial interconnectedness.

Financial crisis of 2008

The global financial crisis of 2008 brought to the fore the downside of a highly complex and interconnected financial system. Through the system’s many links, shocks can propagate rapidly across markets and asset classes. The impact of these cascading effects has been highlighted once again during the current coronavirus crisis, with financial contagion spreading as fast as the disease itself. Understanding financial interconnectedness and capturing it with models is a major challenge. Network theory can provide us with tools and insights that enable us to make sense of the complex interconnected nature of financial systems. Hence, following the 2008 crisis, there has been a significant interest in using network-based models for financial stability and systemic risk.

Despite the growing literature on risk models and networks in finance, specifying pricing and risk management models which take into account financial interconnectedness, still proves challenging. Moreover, most of the studies using network models in finance focus on systemic risk and the resilience of the financial system to shocks. The qualitative nature of this line of research can hardly provide quantitative risk metrics that can be applied to models for measuring the risk of individual portfolios.

Bayesian networks

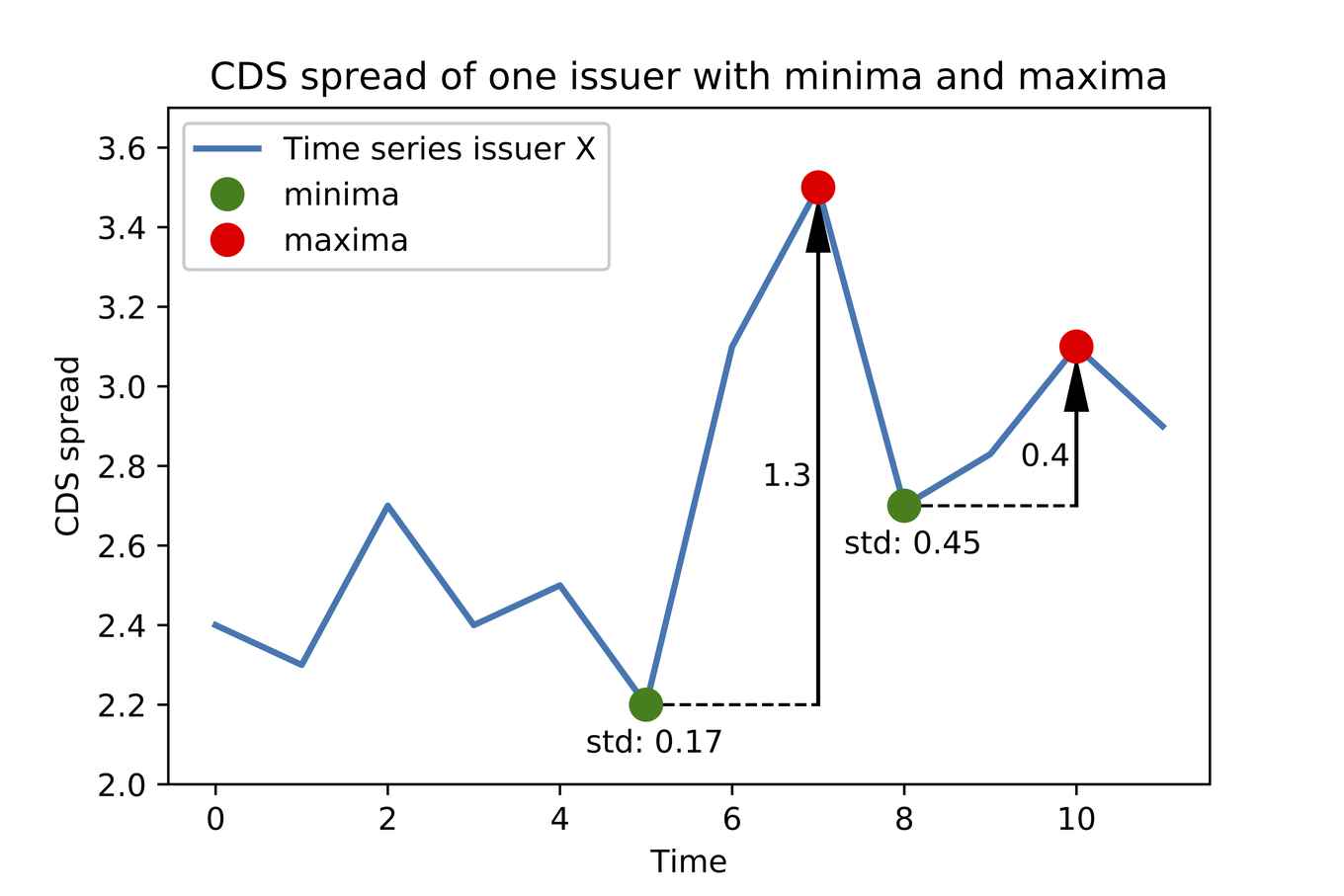

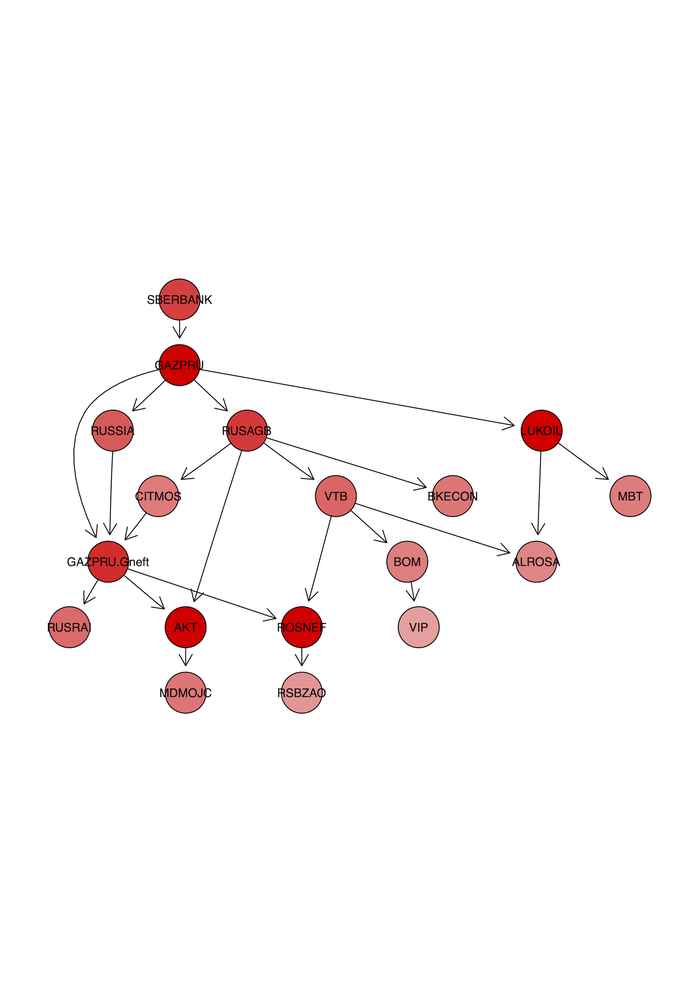

Researchers from UvA, together with collaborators from the financial industry, took up this challenge, introducing a method for estimating contagion effects from credit default swaps (CDS) data using Bayesian networks (BNs) and incorporating these effects in actual pricing and risk management models. A BN is a probabilistic graphical model that represents a set of variables and their conditional dependencies via a directed acyclic graph. The team studied an evaluated different algorithms to learn the structure and the parameters of financial networks.

Quantifying Systemic Risk

Sumit Sourabh, Markus Hofer, and Drona Kandhai developed a novel framework using Bayesian networks to capture distress dependence in the context of counterparty credit risk. Then, they applied this methodology to a wrong-way risk model and stress-scenario testing. Their results showed that stress propagation in an interconnected financial system can have a significant impact on counterparty credit exposures and, as a result, to the pricing of financial derivatives. The article ‘Quantifying Systemic Risk Using Bayesian Networks’ was published in the cutting edge series of Risk journal.

Contagious Defaults in a Credit Portfolio

In an additional contribution by Ioannis Anagnostou, Javier Sanchez Rivero, Sumit Sourabh, and Drona Kandhai, a method to enhance credit portfolio models based on the model of Merton by incorporating contagion effects was proposed. While, in most models, the risks related to financial interconnectedness are neglected, the authors used Bayesian network methods to uncover the direct and indirect relationships between credits while maintaining the convenient representation of factor models. Their approach was demonstrated in detail in a stylized portfolio, and the impact on unexpected losses, and consequently on capital buffers, was found to be significant. The article ‘Contagious Defaults in a Credit Portfolio: A Bayesian Network Approach’ was published in the Journal of Credit Risk.

Data-driven methods

The issues discussed above highlight the need for a dynamic extension of the current modelling framework by accounting for financial interconnectedness. Data-driven methods can be used to estimate contagion effects, which need to be incorporated in the current computational models for pricing and risk management. This direction has been taken in the aforementioned articles.